What is a Continuous Balance Sheet

Difference Between Bank Balance Sheet and Company Balance Sheet

A bank balance sheet preparation is complicated since the banking institutions will need to calculate their net loans, which is time-consuming. The items recorded in this balance sheet are loans, allowances, Short Term Loan Short-term loans are defined as borrowings undertaken for a short period to meet immediate monetary requirements. read more etc. In contrast, preparing a company's balance sheet is not that complicated and time-taking, and it records items like assets, liabilities, and net worth. Before we go into the nitty-gritty of the bank's balance sheet and any regular company, first, we need to look into the nature of each.

The bank acts as an intermediary between two parties. The job of a bank is to assist the company in which it can help. Bank makes profits from the spread between the rate it receives and pays.

On the other hand, a company operates to produce goods or services and ultimately sells these goods or services to another business, end customer, or Government. Running a regular company aims to generate and maximize wealth Wealth maximization means the maximization of the shareholder's wealth as a result of an increase in share price thereby increasing the market capitalization of the company. The share price increase is a direct function of how competitive the company is, its positioning, growth strategy, and how it generates profits. read more for its shareholders.

As the nature of both of these entities is different, it makes sense to prepare a unique balance sheet for each of them.

Table of contents

- Difference Between Bank Balance Sheet and Company Balance Sheet

- Bank Balance Sheet vs. Company Balance Sheet [Infographics]

- Structure of Bank's Balance Sheet

- Schedules in a Bank Balance Sheet

- Average balance

- Loans

- Short term investments

- Format and example of Balance Sheet of Bank

- Structure of the Company's Balance Sheet

- Assets

- Liabilities

- Shareholders' Equity

- Format & example of the balance sheet of a regular company

- Key differences – Bank Balance Sheet vs. Company Balance Sheet

- Bank Balance Sheet vs. Company Balance Sheet [Comparison Table]

- Conclusion – Bank Balance Sheet vs. Company Balance Sheet

- Bank Balance Sheet vs. Company Balance Sheet Video

- Recommended Articles

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Bank Balance Sheet vs Company Balance Sheet (wallstreetmojo.com)

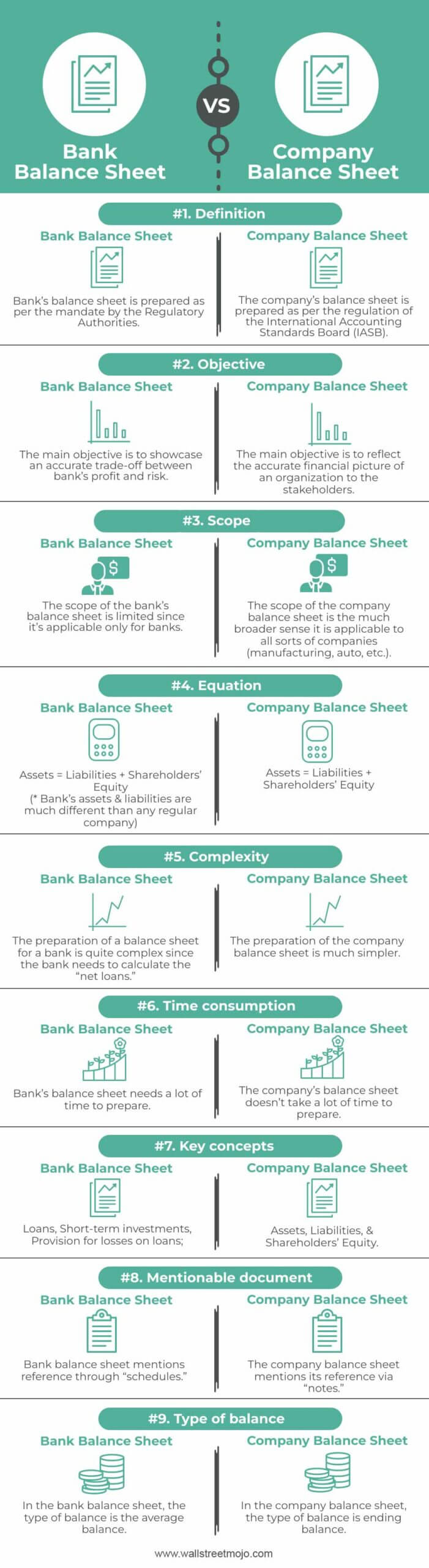

Bank Balance Sheet vs. Company Balance Sheet [Infographics]

The differences between Bank Balance Sheet vs. Company Balance Sheet are as follows –

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Bank Balance Sheet vs Company Balance Sheet (wallstreetmojo.com)

Structure of Bank's Balance Sheet

Bank Balance Sheet The main purpose of the Balance sheet is to give the understanding to its users about the financial position of the business at the particular point of time by showing the details of the assets of the company along with its liabilities and owner's capital. read more is prepared differently from the Company Balance Sheet. The first few items on the Balance Sheet of a Bank are similar to the Balance Sheet of a Regular Company. For example, cash, securities, etc., come under assets on the Bank's Balance Sheet.

Schedules in a Bank Balance Sheet

Schedules are mentioned in a Bank Balance Sheet because schedules refer to additional information. Key schedules that are being used in the bank balance sheets are –

- Deposits

- Borrowings

- Capital

- Reserves & Surpluses

- Cash on hand

- Investments

- Liabilities

Average balance

One of the unique characteristics of the bank balance sheet is that all the balances that take place on the balance sheet are average amounts. Therefore, taking average amounts provides a better idea about the financial affairs of the bank.

However, what separates the bank from the other regular company is that the bank takes more risk than any regular company.

Loans

This is one of the ways banks earn money. Banks provide loans to various customer segments. Two of the basic loans bank offers are personal loans and mortgage loans. Personal loans are given with an interest rate and without any mortgage. Usually, the interest rate remains higher in personal loans.

Mortgage loans are given against a mortgage. As the loans are offered against a mortgage, the interest rate is usually lower. But if the individual cannot pay off the loans, the mortgage is claimed by the bank.

Banks also create an allowance in the balance sheet to cover losses from the loans (if any) and change the structure of this allowance depending on the economic factors Economic factors are external, environmental factors that influence business performance, such as interest rates, inflation, unemployment, and economic growth, among others. read more going on in the market.

Short term investments

To the banks, short term investments Short term investments are those financial instruments which can be easily converted into cash in the next three to twelve months and are classified as current assets on the balance sheet. Most companies opt for such investments and park excess cash due to liquidity and solvency reasons. read more are also of utter importance. That's they include cash, securities under short term investments. These short term investments do three things –

- First, short term investments lower the duration of total assets Total Assets is the sum of a company's current and noncurrent assets. Total assets also equals to the sum of total liabilities and total shareholder funds. Total Assets = Liabilities + Shareholder Equity read more .

- Second, short term investments also lower the chances of loan default risk Default risk is a form of risk that measures the likelihood of not fulfilling obligations, such as principal or interest repayment, and is determined mathematically based on prior commitments, financial conditions, market conditions, liquidity position, and current obligations, among other factors. read more .

- And lastly, short term investments also increase liquidity.

Format and example of Balance Sheet of Bank

ABC Bank Balance Sheet

| Particulars | Schedule | Amount (in US $, millions) |

| Assets | ||

| Cash balances | 8 | 30,000 |

| Residential mortgage | 25,000 | |

| Federal funds sold & securities purchased | 11,000 | |

| Commercial | 23,000 | |

| Investments | 7 | 43,000 |

| Credit Card | 3500 | |

| Advances | 6 | 12,500 |

| Commercial Loans Commercial loans are short-term loans used to raise a company's working capital and meet heavy expenses and operational costs. It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds. Banks and well-established financial institutions often provide commercial loans against the debtor's financial statements and credit score. read more | 2,000 | |

| Leases | 4,500 | |

| Accumulated Depreciation The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. It is a contra-account, the difference between the asset's purchase price and its carrying value on the balance sheet. read more | 5 | 500 |

| Allowance for loan & leases Leasing is an arrangement in which the asset's right is transferred to another person without transferring the ownership. In simple terms, it means giving the asset on hire or rent. The person who gives the asset is "Lessor," the person who takes the asset on rent is "Lessee." read more losses | 4 | 7,000 |

| Total Assets | 162,000 | |

| Liabilities | ||

| Savings | 45,000 | |

| Time Deposits | 34,000 | |

| Money Market Deposits | 26,000 | |

| Federal funds sold and purchased under agreement to repurchase A repurchase agreement or repo is a short-term borrowing for individuals who deal in government securities. Such an agreement can happen between multiple parties into three types- specialized delivery, held-in-custody repo and third-party repo. read more | 5,500 | |

| Interest bearing long term debt Long-term debt is the debt taken by the company that gets due or is payable after one year on the date of the balance sheet. It is recorded on the liabilities side of the company's balance sheet as the non-current liability. read more | 3 | 13,000 |

| Non-interest bearing liabilities | 2 | 3,500 |

| Shareholders' Equity | 1 | 35,000 |

| Total liabilities & shareholders' equity | 162,000 |

Structure of the Company's Balance Sheet

The balance sheet of a regular company is similar to a simple balance sheet format.

The balance sheet of a regular company will balance two sides – assets and liabilities.

For example, if a company takes a loan from a bank of $50,000, the transaction will take place on the balance sheet in the following manner –

- Firstly, on the "asset" side, we will include "Cash" of $50,000.

- Secondly, on the "liability" side, we will include "Debt" of $50,000.

For one transaction, there are two consequences, and the balance sheet balances these two.

Let's now understand "assets" and "liabilities."

Assets

Under "assets," first, we will talk about "current assets." Current assets are assets that can be liquidated quickly in cash. Here are the items that come under current assets –

- Cash & Cash Equivalents

- Short-term investments

- Inventories

- Trade & Other Receivables

- Prepayments & Accrued Income Accrued Income is that part of the income which is earned but hasn't been received yet. This income is shown in the balance sheet as accounts receivables. read more

- Derivative Assets

- Current Income Tax Assets

- Assets Held for Sale

- Foreign Currency

- Prepaid Expenses Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future. Payment for the goods is made in the current accounting period, but the delivery is received in the upcoming accounting period. read more

Here's an example for you –

| A (in US $) | B (in US $) | |

| Cash | 4500 | 5600 |

| Cash Equivalent | 6500 | 3400 |

| Accounts Receivable | 7000 | 8000 |

| Inventories | 8000 | 7000 |

| Total Current Assets | 26,000 | 24,000 |

Now, let's talk about "non-current assets."

Non-current assets Non-current assets are long-term assets bought to use in the business, and their benefits are likely to accrue for many years. These Assets reveal information about the company's investing activities and can be tangible or intangible. Examples include property, plant, equipment, land & building, bonds and stocks, patents, trademark. read more are also called fixed assets. They will pay you off for more than one year, and they can't easily be liquidated.

Under "non-current assets," we would include the following items –

- Property, plant, and equipment

- Goodwill

- Intangible assets Intangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. read more

- Investments in associates & joint ventures A joint venture is a commercial arrangement between two or more parties in which the parties pool their assets with the goal of performing a specific task, and each party has joint ownership of the entity and is accountable for the costs, losses, or profits that arise out of the venture. read more

- Financial assets Financial assets are investment assets whose value derives from a contractual claim on what they represent. These are liquid assets because the economic resources or ownership can be converted into a valuable asset such as cash. read more

- Employee benefits assets

- Deferred tax assets

If we add both current and noncurrent assets, we will get the total assets of a regular company.

Liabilities

In Liabilities also, we will start with "current liabilities."

Current liabilities are liabilities that can be paid in a very short duration. Here are the items that we would include under current liabilities –

- Financial Debt (Short term)

- Trade & Other Payables

- Provisions

- Accruals & Deferred Income Deferred Revenue, also known as Unearned Income, is the advance payment that a Company receives for goods or services that are to be provided in the future. The examples include subscription services & advance premium received by the Insurance Companies for prepaid Insurance policies etc. read more

- Current Income Tax Liabilities

- Derivative Liabilities

- Accounts Payable

- Sales Taxes Payable

- Interests Payable Interest Payable is the amount of expense that has been incurred but not yet paid. It is a liability that appears on the company's balance sheet. read more

- Short Term Loan

- Current maturities of long term debt Current Portion of Long-Term Debt (CPLTD) is payable within the next year from the date of the balance sheet, and are separated from the long-term debt as they are to be paid within next year using the company's cash flows or by utilizing its current assets. read more

- Customer deposits in advance

- Liabilities directly associated with assets held for sale

Now we will look at an example of current liabilities Current Liabilities are the payables which are likely to settled within twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc. read more –

| M (in US $) | N (in US $) | |

| Accounts Payable | 21000 | 31600 |

| Current Taxes Payable | 17000 | 11400 |

| Current Long-term Liabilities | 8000 | 12000 |

| Total Current Liabilities | 46000 | 55000 |

We will now have a look at the "non-current liabilities." These liabilities are long term liabilities Long Term Liabilities, also known as Non-Current Liabilities, refer to a Company's financial obligations that are due for over a year (from its operating cycle or the Balance Sheet Date). read more , which the company will pay off within a long period of time.

In "non-current liabilities," we will include the following –

- Financial Debt (Long term)

- Provisions

- Employee Benefits Liabilities

- Deferred Tax Liabilities Deferred tax liabilities arise to the company due to the timing difference between the accrual of the tax and the date when the company pays the taxes to the tax authorities. This is because taxes get due in one accounting period but are not paid in that period. read more

- Other Payables

By adding the "current liabilities" and "non-current liabilities," we will get "total liabilities."

To complete the balance sheet of a regular company, we have only one thing left. And that is "shareholders' equity."

Shareholders' Equity

Shareholders' equity Shareholder's equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders' Equity Statement on the balance sheet details the change in the value of shareholder's equity from the beginning to the end of an accounting period. read more is the statement that includes that share capital Share capital refers to the funds raised by an organization by issuing the company's initial public offerings, common shares or preference stocks to the public. It appears as the owner's or shareholders' equity on the corporate balance sheet's liability side. read more and all other related adjustments. Here's a format of shareholders' equity –

| Shareholders' Equity | |

| Paid-in Capital: | |

| Common Stock | *** |

| Preferred Stock | *** |

| Additional Paid-up Capital Additional paid-in capital or capital surplus is the company's excess amount received over and above the par value of shares from the investors during an IPO. It is the profit a company gets when it issues the stock for the first time in the open market. read more : | |

| Common Stock | ** |

| Preferred Stock | ** |

| Retained Earnings Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner's equity in the liability side of the balance sheet of the company. read more | *** |

| (-) Treasury Shares | (**) |

| (-) Translation Reserve | (**) |

If we add total liabilities and shareholders' equity, we will get a number that should match the total assets.

Now we will look at the format and example of the balance sheet A balance sheet is a statement that shows the financial position of the organization as on any specified date. The balance sheet has two sides: the Asset side and the Liability side. The asset side shows Non-current Assets and Current Assets. The liability side shows the Owner's Capital and Current as well as Non-Current Liability. read more of a regular company.

Format & example of the balance sheet of a regular company

Balance Sheet of ABC Company

| 2016 (In US $) | 2015 (In US $) | |

| Assets | ||

| Current Assets | 250,000 | 550,000 |

| Investments | 36,00,000 | 39,50,000 |

| Plant & Machinery | 22,00,000 | 15,60,000 |

| Intangible Assets | 35,000 | 25,000 |

| Total Assets | 60,85,000 | 60,85,000 |

| Liabilities | ||

| Current Liabilities | 175,000 | 210,000 |

| Long term Liabilities | 85,000 | 175,000 |

| Total Liabilities | 260,000 | 385,000 |

| Stockholders' Equity | ||

| Preferred Stock | 450,000 | 450,000 |

| Common Stock | 49,95,000 | 50,00,000 |

| Retained Earnings | 380,000 | 250,000 |

| Total Stockholders' Equity | 58,25,000 | 57,00,000 |

| Total liabilities & Stockholders' Equity | 60,85,000 | 60,85,000 |

Key differences – Bank Balance Sheet vs. Company Balance Sheet

The differences between Bank Balance Sheet vs. Company Balance Sheet are as follows –

- The bank's balance sheet is quite different from the Balance Sheet of a Regular Company in the approach of preparation. Both are prepared quite differently.

- The assets and liabilities of a bank are much different from a regular company's assets and liabilities. That's why even if the arrangement of the bank and a regular company is similar, the items are always different.

- In the banks' balance sheet, the average balances are summed up and recorded. It gives a better framework for the financial performance of the banks. On the other hand, the balance sheet of a regular company takes the ending balance from the trial balance. Trial balance is prepared from the ledger accounts Ledger in accounting records and processes a firm's financial data, taken from journal entries. This becomes an important financial record for future reference. It is used for creating financial statements. It is also known as the second book of entry. read more . And then, from trail balance, the ending balance is transferred to the balance sheet of a regular company.

- To show new information, the bank's balance used "schedules." On the other hand, to show new information, a balance sheet of a regular company uses "notes."

- To prepare a balance sheet for a bank, an accountant has to go through a lot of information. S/he needs to look through the short-term investments of the banks, the loans (personal & mortgage), deposits, interest paid & received, etc. That's why preparing the balance sheet of a bank is quite cumbersome. On the other hand, preparing the balance sheet of a regular company is pretty easy. All you need to do is find out current assets Current assets refer to those short-term assets which can be efficiently utilized for business operations, sold for immediate cash or liquidated within a year. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. read more , fixed assets, current liabilities, non-current liabilities, and shareholders' equity. And you would be able to prepare the balance sheet easily.

- Banks take more risks than any other company. That's why in the bank's balance sheet, a separate provision (allowance) is created to cover the losses on loans. There Are provisions for bad debts A bad debt provision refers to the reserve made by a company to set aside an amount computed as a specific percentage of overall doubtful or bad debts that has to be written off in the next year. read more or creditors in the balance sheet of a regular company, but they are not similar to allowance created in the bank's balance sheet.

- Many economic factors affect the balance sheet of a bank The bank's balance sheet is different from the company's balance sheet. It is prepared on the mandate by the Bank's Regulatory Authorities to reflect the tradeoff between the bank's profit and its risk and its financial health. read more . But in the case of a regular company, rarely external events affect the preparation of the balance sheet.

Also, check out the Balance Sheet vs. Consolidated Balance Sheet A balance sheet is one of the company's financial statements, which presents the company's liabilities and assets. In contrast, the consolidated balance sheet is the extension with the company's balance sheet items, including the subsidiary companies balance sheet items. read more

Bank Balance Sheet vs. Company Balance Sheet [Comparison Table]

| Basis for Comparison – Bank Balance Sheet vs. Company Balance Sheet | Balance Sheet of Bank | Balance Sheet of a Regular Company |

| 1. Definition | Bank's balance sheet is prepared as per the mandate by the Regulatory Authorities | The company's balance sheet is prepared as per the regulation of the International Accounting Standards Board (IASB). |

| 2. Objective | The main objective is to showcase an accurate trade-off between bank's profit and risk. | The main objective is to reflect the accurate financial picture of an organization to the stakeholders. |

| 3. Scope | The scope of the bank's balance sheet is limited since it's applicable only for banks. | The scope of the company balance sheet is the much broader sense it is applicable to all sorts of companies (manufacturing, auto, etc.). |

| 4. Equation – Bank Balance Sheet vs. Company Balance Sheet | Assets = Liabilities + Shareholders' Equity (* Bank's assets & liabilities are much different than any regular company) | Assets = Liabilities + Shareholders' Equity |

| 5. Complexity | The preparation of a balance sheet for a bank is quite complex since the bank needs to calculate the "net loans." | The preparation of the company balance sheet is much simpler. |

| 6. Time consumption | Bank's balance sheet needs a lot of time to prepare. | The company's balance sheet doesn't take a lot of time to prepare. |

| 7. Key concepts – Bank Balance Sheet vs. Company Balance Sheet | Loans, Short-term investments, Provision for losses on loans; | Assets, Liabilities, & Shareholders' Equity. |

| 8. Mentionable document | Bank balance sheet mentions reference through "schedules." | The company balance sheet mentions its reference via "notes." |

| 9. Type of balance | In the bank balance sheet, the type of balance is the average balance. | In the company balance sheet, the type of balance is ending balance. |

Conclusion – Bank Balance Sheet vs. Company Balance Sheet

If you look at a balance sheet of a regular company, you will have a surface-level idea about how a balance sheet works. For example, the bank's balance sheet is arranged similarly, but the items under the heads are different.

Moreover, banks use the average balance for their balance sheets, which is unique if we compare it with the regular company operations.

Even if these balance sheets are quite different in scope, the objective of both of them is quite similar, i.e., to disclose an accurate picture of the organization's financial affairs.

Bank Balance Sheet vs. Company Balance Sheet Video

Recommended Articles

This has been a guide to Bank Balance Sheet vs. Company Balance Sheet. Here we discuss the top difference between bank balance sheets and company balance sheets, infographics, and a comparison table. You may also have a look at the following articles –

- Balance Sheet Formula Balance Sheet Formula is a fundamental accounting equation which mentions that, for a business, the sum of its owner's equity & the total liabilities equal to its total assets, i.e., Assets = Equity + Liabilities read more

- Examples of Deferred Tax Assets A deferred tax asset is an asset to the Company that usually arises when either the Company has overpaid taxes or paid advance tax. Such taxes are recorded as an asset on the balance sheet and are eventually paid back to the Company or deducted from future taxes. read more

- Balance Sheet Equation Definition

Source: https://www.wallstreetmojo.com/bank-balance-sheet-vs-company-balance-sheet/

0 Response to "What is a Continuous Balance Sheet"

Postar um comentário